For most working Aussies, the short answer is a big yes, novated leases are definitely worth looking into. They’re a genuinely clever way to get behind the wheel of a new or used car by bundling all your vehicle and running costs into one simple payment, taken straight from your pre-tax salary. This is a powerful salary packaging tool that can seriously lower your taxable income and save you a bundle on tax.

The Straight Answer on Novated Leases

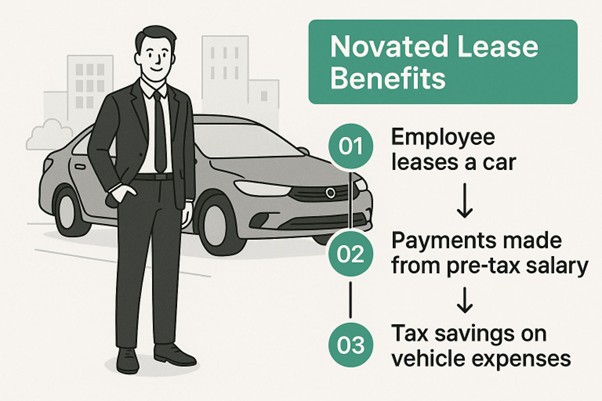

When you hear “novated lease,” it’s easy for your eyes to glaze over from all the finance jargon. But at its heart, the concept is surprisingly simple and a powerful way for employees to save money.

Think of it as a three-way handshake between you, your employer, and a leasing company like WhipSmart. Instead of paying for your car with your after-tax dollars—the money that hits your bank account—the payments come out of your gross salary. This simple switch is the key that unlocks some major savings.

How You Save Money

The benefits of a novated lease start to stack up pretty quickly, making it one of the most cost-effective ways to own and run a car in Australia. The main advantages really come down to tax.

- Serious Income Tax Reduction: By paying for your car and its running costs before tax is calculated, you shrink your total taxable income. This means you hand over less to the ATO each pay cycle and keep more of your hard-earned cash.

- Massive GST Savings: This one is huge. You don’t pay the 10% Goods and Services Tax (GST) on the purchase price of your car. Even better, you also save the GST on all your bundled running costs—think insurance, rego, servicing, and even petrol or EV charging.

The popularity of novated leasing is growing for a good reason: the savings are real and they add up. That 10% GST saving on the car’s price is a massive upfront win. For example, a car with a $66,000 drive-away price would only require a salary sacrifice amount of $60,000. That’s a $6,000 saving from day one. You can learn more about these novated lease benefits and see how they’re calculated.

The EV Game-Changer: If you’re thinking about an electric vehicle, the deal gets even sweeter. Thanks to a government incentive, eligible EVs are exempt from Fringe Benefits Tax (FBT), which can save you thousands more every year. It’s a massive win for both your wallet and the planet.

How a Novated Lease Actually Works

At its heart, a novated lease is just a clever three-way agreement between you, your employer, and a finance company like WhipSmart. It sounds more complex than it really is. The “novation” part is simply your employer agreeing to take on the lease obligations for your car, paying for it directly from your salary before any tax is taken out.

Forget the hassle of managing multiple car-related bills. A novated lease rolls everything you’d normally pay for separately into one simple, predictable payment.

This single payment is made up of two key parts:

- Car Finance: This covers the cost of the car itself.

- Running Costs Budget: This bundles all your other vehicle expenses. We’re talking about everything from rego and insurance to servicing, tyres, and even petrol or EV charging.

Think of it like an all-inclusive subscription for your car. You get the convenience of a single, regular payment and can finally say goodbye to the headache of surprise repair bills or big rego payments.

This image really captures the essence of it; a novated lease is all about making it simpler and more affordable to drive your ideal car by using your salary in a much smarter way.

The Step-by-Step Process

So, how does this all come together in the real world? The process is surprisingly straightforward, and we handle all the heavy lifting for you.

- You Choose Your Car: First, you pick any new or used car you like. Whether it’s a Tesla Model Y or a trusted family SUV, the choice is completely yours.

- We Create a Budget: We’ll then work with you to map out a realistic budget for all your running costs, based on how much you drive. This budget gets rolled into your single lease payment.

- Your Employer Pays: Your employer then makes that single payment directly from your pre-tax pay each pay cycle. Simple.

- You Drive and Save: You get behind the wheel of your new car and enjoy the significant tax savings and the simplicity of one fixed payment.

Key Takeaway: A novated lease simplifies car ownership by bundling all your costs into a single payment made from your pre-tax salary. This structure is the secret sauce that allows you to pay less income tax and save the GST on both the car and its running costs, making it a powerful financial tool for many Australians.

Unpacking the Real Tax Savings

This is where a novated lease goes from being a good idea to a brilliant one. The real power behind this financial tool comes from two massive tax advantages that can leave a lot more money in your pocket at the end of the day. Let’s break down exactly how you save.

Pay for Your Car with Pre-Tax Dollars

This is the first, and arguably the biggest, win. Ordinarily, you pay for your car and all its running costs from your net pay—the money that actually hits your bank account after the tax man has taken his slice. A novated lease completely flips this on its head.

Your car payments and budgeted running costs are pulled from your gross salary. This means the money is deducted before your income tax is calculated.

How it works: By paying for your car with pre-tax dollars, you effectively lower your official taxable income. The less taxable income you report, the less tax you owe the ATO. It’s a simple, legal, and powerful way to reduce your tax bill every single payday.

For example, if you earn $80,000 a year and your total novated lease costs are $10,000, you are now only taxed as if you earn $70,000. That drop in taxable income means you pay significantly less tax over the year, which translates directly to more cash in your hand.

Say Goodbye to GST on Your Car and Costs

The second major benefit is the Goods and Services Tax (GST) saving, and it’s a big one. When you get a car through a novated lease, the finance company (that’s us!) actually buys the vehicle and can claim back the GST. This saving is then passed directly on to you.

That’s an instant 10% upfront discount on the purchase price of your new car, which can add up to thousands of dollars right from the get-go.

But the savings don’t stop there. This GST-free advantage also applies to all your budgeted running costs for the entire life of the lease. This includes:

- Petrol or EV charging

- Comprehensive insurance and CTP

- Registration

- Servicing and maintenance

- Tyres

Every time you fill up the tank or plug in your EV, you’re not paying the GST component. Over a three or five-year lease, these small savings compound into a pretty significant amount of extra cash.

On top of all this, the Australian Government has introduced changes that really supercharge these benefits for electric vehicles. Recent legislative updates have made novated leases even more attractive, especially for EV buyers. A key change from 1 July 2022 removed the Fringe Benefits Tax (FBT) for eligible electric and low-emission vehicles, a benefit that continues to make a huge impact.

For the 2024-2025 financial year, this means you can get into a zero-emission car at a much lower cost and also receive an upfront GST discount of up to $6,334 on the vehicle itself. You can learn more about how these novated lease tax changes affect you.

Why Novated Leases Are a Game Changer for EVs

https://www.youtube.com/watch?v=p8SNpcIW94w

If you’ve been curious about making the switch to an electric vehicle but the upfront cost feels a bit steep, this is the part you can’t afford to skip. A powerful government incentive has turned the already smart novated lease into what is, for many Aussies, the single most affordable way to get behind the wheel of an EV.

The hero of this story is the Fringe Benefits Tax (FBT) exemption.

What Is FBT and Why Is This a Huge Deal?

So, what exactly is this FBT thing? In simple terms, Fringe Benefits Tax is a tax employers have to pay on certain benefits they provide to their staff, like a company car. For a regular petrol or diesel car on a novated lease, this FBT cost is usually passed on to the employee, which can add a hefty amount to your payments.

But the game completely changed on 1 July 2022. That’s when the government introduced an FBT exemption specifically for eligible zero and low-emission vehicles.

This means if you lease an eligible EV, neither your employer nor you have to pay any FBT. This isn’t just a small discount; it can literally save you thousands of dollars every single year compared to leasing an equivalent petrol car. It’s a massive win for your back pocket and a big thumbs-up for the planet.

When you combine the FBT exemption with pre-tax payments and GST savings, the total cost of driving a premium EV can plummet. Suddenly, a brand new Tesla Model Y Long Range can become more affordable to run each week than many popular petrol cars.

The Numbers Don’t Lie

This powerful incentive has triggered a massive shift in the market. The Australian novated lease sector has seen a huge jump in interest, tied directly to the skyrocketing demand for electric and plug-in hybrid vehicles (PHEVs).

In the year leading into early 2025, referrals for novated leases climbed by a staggering 65%, a surge driven almost entirely by these attractive government incentives. Plug-in hybrid sales alone more than doubled in 2024, showing just how many Aussies are taking advantage of the savings. You can read more about this EV demand surge on MPA Mag.

For anyone who’s been EV-curious, this really simplifies the decision. The combination of savings creates a compelling financial case that often makes going electric a complete no-brainer. At WhipSmart, we specialise in helping people unlock these maximum savings for electric cars, making the switch seamless and incredibly cost-effective.

Weighing the Pros and Cons of a Novated Lease

Alright, so a novated lease sounds pretty good on paper. But just like any big financial decision, it’s always smart to look at both sides of the coin before jumping in.

While it’s a brilliant tool for heaps of Aussies, it’s not a one-size-fits-all solution. Let’s break down the good stuff and the things you’ll want to keep in mind to figure out if it’s the right move for you.

Pros: The Good Stuff

The upsides of a novated lease are pretty clear and can make a huge difference to your budget. They’re designed to make your life simpler and keep more cash in your pocket.

- Massive Tax Savings: This is the big one. Paying for your car and all its running costs from your pre-tax salary means your taxable income drops. Less taxable income means less tax paid to the ATO. Simple.

- No GST on Your Car or Running Costs: You get to skip the 10% GST not just on the car’s purchase price, but also on your budgeted running costs. Think petrol, rego, insurance, and servicing—all without the GST. Those savings add up fast.

- Budgeting Made Easy: Forget trying to remember when big bills are due. Everything is bundled into one fixed, predictable payment that comes straight out of your pay. No more nasty surprises when your rego or insurance renewal lands in your inbox.

- Access to Fleet Discounts: We buy a lot of cars, which gives us access to fleet pricing the general public can’t get. We pass those savings directly on to you, so you can often get a bit more car for your money.

Cons: Things to Consider

Now, to give you the full picture, it’s important to be aware of the other side. A novated lease is a commitment, and it pays to understand all the details.

- It’s a Lease Agreement: You’re signing up for a set term, usually between one and five years. While this gives you stability, it’s naturally less flexible than just buying a car with cash.

- What if I Change Jobs? This is a really common concern, but it’s not the deal-breaker it used to be. If you move to a new employer, we can help you transfer the lease over. With a modern provider like WhipSmart, this process is surprisingly straightforward.

- The Residual Value: At the end of the lease, the ATO requires a final lump-sum payment, known as the residual or ‘balloon’ payment. You have a few options here: you can pay it off to own the car outright, or, more commonly, you can trade the car in. The trade-in value is then used to cover the residual before you start a new lease on a brand-new car.

Pros vs Cons of a Novated Lease

So, how does it all stack up? Here’s a quick-glance table to help you weigh the good against the considerations.

Pros (The Good Stuff)Cons (Things to Consider)Significant income tax reductions.Locked into a fixed-term agreement.No GST on the car purchase or running costs.Can be complex if you change jobs (though we help).All car expenses bundled into one simple payment.Requires a final ‘residual’ payment at the end.Access to fleet discounts on new cars.Less flexible than a cash purchase.Ultimately, whether a novated lease is “worth it” really comes down to running the numbers for your specific situation. The savings potential is huge, but it’s a structured financial product.

The best way to know for sure is to get a personalised quote. It costs nothing to look, and you’ll see exactly how the savings could work for you.

So, Is a Novated Lease Right for You?

Working out if a novated lease fits your life really boils down to a few straightforward questions. At its heart, are you a PAYG employee, eyeing off a new or near-new car, and keen on the idea of slashing your tax bill and running costs? If you’re nodding your head, then a novated lease is probably a brilliant move for you.

It’s an especially good fit if you see yourself in one of these scenarios:

- The Daily Commuter: You just want a reliable, modern car without the headache of surprise bills for things like rego or the next service.

- The EV Enthusiast: You’re ready to make the switch to an electric vehicle and want to milk the huge FBT exemption for all it’s worth, potentially making an EV cheaper than a petrol car.

- The Growing Family: You need a safe, new car loaded with all the bells and whistles but want to keep a tight rein on the family budget.

While the benefits sound great on paper, the real proof is always in the numbers. The only way to truly grasp how much you could save is to see a personalised breakdown based on your income, the car you’re dreaming of, and how much you drive.

Honestly, the best way to know for sure if a novated lease is worth it for you is to see the figures for yourself. Get a personalised quote in under 60 seconds and find out just how much you could be saving. At WhipSmart, we’re here to help you drive smarter.

Your Novated Lease Questions, Answered

Still got a few things on your mind? No problem. It’s completely normal to have questions when you’re exploring something new like a novated lease. Let’s tackle some of the most common queries we get here at WhipSmart to help clear things up.

What Happens to My Novated Lease if I Leave My Job?

This is probably the number one question we hear, and the answer is reassuringly simple. You’re not locked in forever. If you move on from your current employer, you’ve got a few straightforward choices:

- Take it with you: The most common option is to simply transfer the lease to your new employer. We can help you and your new boss get this sorted smoothly.

- Buy the car: You can decide to pay out the remaining lease amount, which ends the agreement and makes the car yours, free and clear.

- Switch to a loan: Another path is to refinance the outstanding amount into a regular car loan, so you can keep driving the car under a more traditional finance structure.

What Is the Residual Value or Balloon Payment?

Think of the residual value (often called a balloon payment) as a final, one-off payment due at the end of your lease term. The Australian Taxation Office (ATO) sets this amount as a percentage of the car’s initial cost, aiming to reflect what the car will likely be worth when your lease is up.

When you reach the end of the term, you have three main options:

- Pay the residual value and take full ownership of the car.

- Trade the car in for a new one. The trade-in value is used to pay off the residual, and any extra cash can go towards your next car. This is by far the most popular choice!

- Refinance the residual amount into a new loan and just keep driving the same car.

Can I Get a Novated Lease for a Used Car?

You bet! In fact, heaps of savvy drivers choose to lease a quality second-hand car. It’s a fantastic strategy to get all the tax-saving perks of a novated lease while taking advantage of the lower price of a pre-owned vehicle.

There are usually a couple of conditions, mainly around how old the car will be at the end of the lease, but it’s a very common and smart way to make your money go further.